Misleading

FACT-CHECKED

- 29.10.2025

SBP’s 2-hour cooling mechanism for digital mobile wallet transfers is not new but has been in place since April 2023

Posts from multiple users on social media platforms since October 27, 2025, claimed that the State Bank of Pakistan has introduced a new rule requiring a two-hour delay before funds transferred through JazzCash, Easypaisa, and other mobile wallets could be withdrawn or spent. However, there is no such new development and the measure was introduced in 2023 as protection against digital fraud.

Claim

SBP introduces new 2-hour cooling mechanism for digital mobile wallet transfers

Rating Justification

The iVerify Pakistan team reviewed this content and determined that it is misleading.

To reach this conclusion, iVerify Pakistan conducted a keyword search to corroborate the development.

Posts from multiple users on social media platforms since October 27, 2025, claimed that the State Bank of Pakistan (SBP) has introduced a new rule requiring a two-hour delay before funds transferred through JazzCash, Easypaisa, and other mobile wallets could be withdrawn or spent. However, there is no such new development and the measure was introduced in 2023 as protection against digital fraud.

HOW IT STARTED

In a post on X on Oct 27, the focalperson to the Prime Minister’s Youth Programme said: “Good news: The State Bank has introduced a new rule for JazzCash, EasyPaisa, and other mobile banking services. Now, if you send money to someone, that person will not be able to withdraw or spend that amount for two hours. This period is called ‘cooling time’. The purpose of this is that if you accidentally send money to the wrong number, you will have two hours to file a complaint and recover the amount. In other words, this new system has been created to protect against fraud and erroneous transactions.”

The post garnered over 297,000 views.

The same claim was widely shared by other users on X as can be seen here, here, here, here, here, here, here, here and here.

The same claim was also shared on Facebook as can be seen here here,here, here,here, here, here, here, here, here, here, here, here, here, here, here, here and here.

Local digital media outlets also reported on the alleged new development, such as The Daily Independent, Positive Pakistan, The Gulistan Times, Tijarat News.

METHODOLOGY

A fact-check was initiated to determine the veracity of the claim due to its high virality and public interest in the matter.

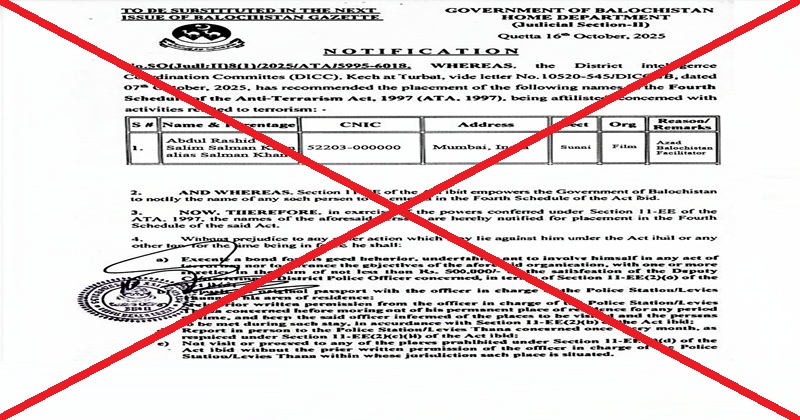

Checking the SBP press release attached to most of the posts clearly showed that it was dated September 28.

The text of the press release is provided below:

“This refers to the news item on social media regarding the two-hours cooling period for digital fund transfers. In this regard, it is clarified that all digital fund transfers are made on real real-time basis and the beneficiaries receive funds in their accounts almost instantly. The two-hours cooling period is applicable only on the usage/cash-out of funds received in branchless banking wallets/accounts. While the funds in the branchless banking wallets/accounts are also received instantly, the cash-outs, online purchases or mobile top-ups against these funds can be made after the two-hours cooling period. This requirement was introduced in April 2023 as the ‘customer due diligence requirements’ for branchless banking accounts are relatively simpler and thus they have greater probability of use in fraudulent transactions. The two-hours cooling period allows sufficient time to the customers to report any fraudulent transactions to their banks. The cooling period instructions issued two and half years back have worked smoothly and proved to be a robust check against fraudulent transactions.”

A keyword search yielded the same press release on the SBP’s website from the same date and no other since then on the matter.

Reports from mainstream credible outlets, such as Express Tribune, The News International and Samaa, were also found from around the same date that also reported on the same press release.

Meanwhile, no reports were found on any new developments about the matter since then.

Approached for corroboration on the matter of any new development since then, an SBP official also redirected the investigation towards the same Sept 28 press release.

In April 2023, the SBP had introduced “Measures to Enhance Security of Digital Banking Products and Services”, including the two-hour cooling period as part of customer protection measures for branchless banking wallets/accounts.

The cooling period was introduced to provide customers a critical window to report unauthorised or suspicious activity and has been in effect for over two and a half years as a safeguard against fraudulent transactions.

FACT-CHECK STATUS: MISLEADING

The claim that the State Bank of Pakistan has newly introduced a two-hour delay restricting usage of all digital mobile wallet transfers is misleading.

The mechanism was already introduced in April 2023, with a clarification subsequently issued about it in September 2025, and no other further development or change has occurred regarding it since. Posts seen sharing the claim continued to present it as a new development, even while sharing the September clarification that provided all details about the mechanism.

Evidence and References

Sept 28, 2025, SBP press release:

https://www.sbp.org.pk/press/2025/Pr-28-Sep-2025.pdf

Sept 29, 2025, Express Tribune news report: https://tribune.com.pk/story/2569464/sbp-clarifies-two-hour-cooling-period-applies-only-to-branchless-banking-transactions

Sept 28, 2025, Samaa news report:

https://www.samaa.tv/2087339750-two-hour-delay-in-using-your-funds-sbp-explains

Sept 29, 2025, The News International news report:

https://www.thenews.com.pk/latest/1347120-sbp-clarifies-digital-transfer-rules

April 2023, SBP annexure:

https://www.sbp.org.pk/bprd/2023/C4-Annex.pdf